Best Loan in India – Trusted Options for Every Need Finding the best loan in India is essential for anyone planning to meet personal or professional financial goals. Whether you want to build a home, grow your business, pursue higher education, or manage unexpected expenses, Indian banks and NBFCs offer a wide range of loan products to suit every requirement.

Popular loan types include:

Finding the best loan in India is essential for anyone planning to meet personal or professional financial goals. Whether you want to build a home, grow your business, pursue higher education, or manage unexpected expenses, Indian banks and NBFCs offer a wide range of loan products to suit every requirement.

Popular loan types include:

Finding the best loan in India is essential for anyone planning to meet personal or professional financial goals. Whether you want to build a home, grow your business, pursue higher education, or manage unexpected expenses, Indian banks and NBFCs offer a wide range of loan products to suit every requirement.

Popular loan types include:

Finding the best loan in India is essential for anyone planning to meet personal or professional financial goals. Whether you want to build a home, grow your business, pursue higher education, or manage unexpected expenses, Indian banks and NBFCs offer a wide range of loan products to suit every requirement.

Popular loan types include:

- Home Loan – Ideal for purchasing or constructing a house, home loans come with long repayment tenures, low interest rates, and tax benefits.

- Personal Loan – There are many personal loan options available for salaried and self-employed individuals. These are unsecured loans useful for emergencies, travel, or medical needs.

- Education Loan – Supports students who wish to study in India or abroad.It covers educational cost expenses, convenience, and other scholarly expenses.

- Business Loan – Idealize for business visionaries and trade proprietors, commerce credits offer assistance in growing operations, overseeing cash stream, or acquiring hardware.

- Gold Loan – A fast and secured loan where gold jewelry is pledged. It is easy to access and disbursed quickly with minimal documentation.

- Overdraft Loan – Overdraft loans provide flexibility to withdraw more than your account balance, useful for short-term financial gaps. Up to 3 types of overdraft facilities are available with different limits.

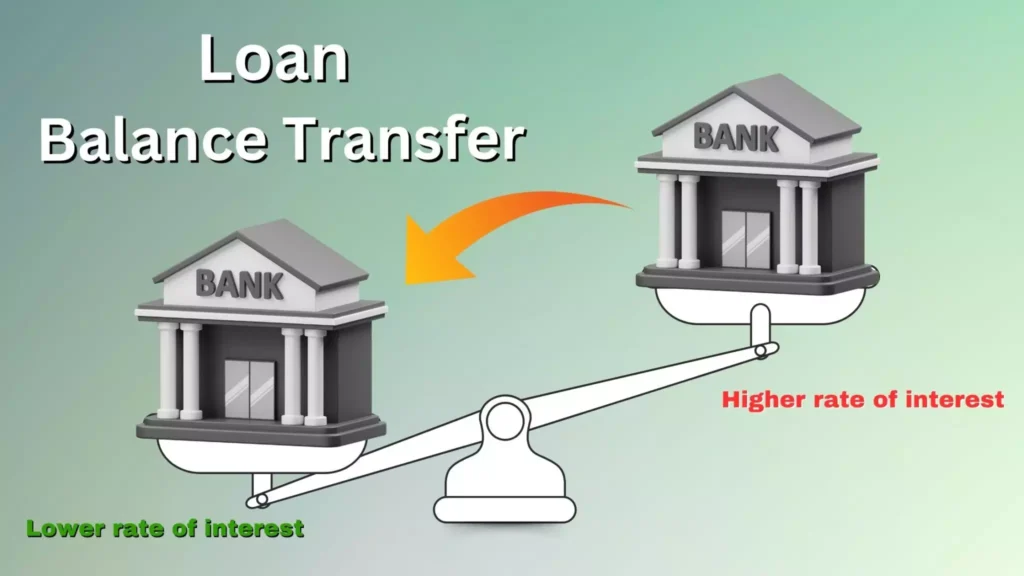

- Balance Transfer – This facility allows borrowers to transfer existing loans to another lender at a lower interest rate, reducing the EMI burden.

8743070181

it is best